If you’re in need of financial assistance and are considering applying for a Universal Credit Loan, this guide will help you understand the application process and what to expect.

Online Application

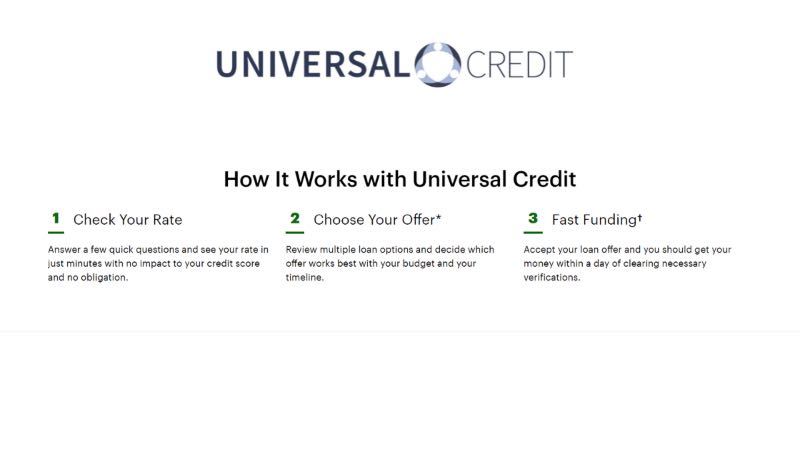

- You can apply for a Universal Credit Loan online through the lender’s website.

- Begin by going through the pre-qualification process, which can give you an idea of whether you’re likely to qualify without impacting your credit score.

- Provide the required personal information and complete the full application.

Requirements

Before applying, ensure you meet the basic requirements:

- Minimum credit score of at least 560.

- Be at least 18 years old.

- Have a valid bank account.

- Have a source of income.

Keep in mind that you can go through the pre-qualification process to see if you qualify without affecting your credit score.

Mobile App

Universal Credit Loans offers a mobile app to assist borrowers in managing their loan funds. With the app, you can:

- Access your loan rates.

- Manage your loan.

- Get assistance from customer service representatives 24/7.

While the mobile app is useful for managing your loan, you’ll still need to complete the initial application process through the lender’s official website.

Comparing Universal Credit Loan to Other Options: Best Egg Loan

If you’re considering Universal Credit Loans but want to explore other alternatives, you can also look into applying for a loan through the Best Egg platform. Best Egg offers a variety of loan options with amounts of up to $50,000.

To help you make an informed decision, you can refer to our comparison table below for a side-by-side look at Universal Credit Loan and Best Egg Loan.

| Universal Credit Loan | Best Egg Loan | |

| APR | From 11.69% to 35.99% variable APR; | From 8.99% to 35.99% variable APR; |

| Loan Purpose | Personal loans of any type and debt consolidation loans; | Debt consolidation, credit card refinancing, home improvements, moving expenses, major purchases, special occasions, vacation loans, secured personal loans, and other personal loan purposes; |

| Loan Amounts | From $1,000 to $50,000; | You can get loan amounts from $2,000 to $50,000; |

| Credit Needed | There is no minimum score, but your loan rates will change depending on your score and finances; | You’ll need a 700 FICO Score minimum to get the lowest APR; |

| Origination Fee | You’ll need to pay a variable origination fee that ranges from 5.25% to 9.99%; | From 0.99% to 8.99% variable origination fee; |

| Late Fee | You may need to pay late fees if you don’t pay your loan on time, and this can increase the cost of your fixed-rate loan; | There can be a late fee if you miss any loan repayments from this lender; |

| Early Payoff Penalty | You won’t need to pay any prepayment fees with this lender. | There are no early payoff penalties for this lender. |

Please feel free to reach out if you have specific questions or if there’s anything else you’d like to know about applying for a loan.

Universal Credit

QUICK PROCESS RELIABLE

Up to $50,000 quickly – ensure the money you need with flexible conditions!